2022 Highlights: Law Firm Financial Index Reports Highlight Trends in Law Firm Profitability

Legal Current’s year-in-review series looks back at 2022 milestones for the Legal Professionals business. Today we revisit the quarterly Law Firm Financial Index (LFFI) reports from the Thomson Reuters Institute.

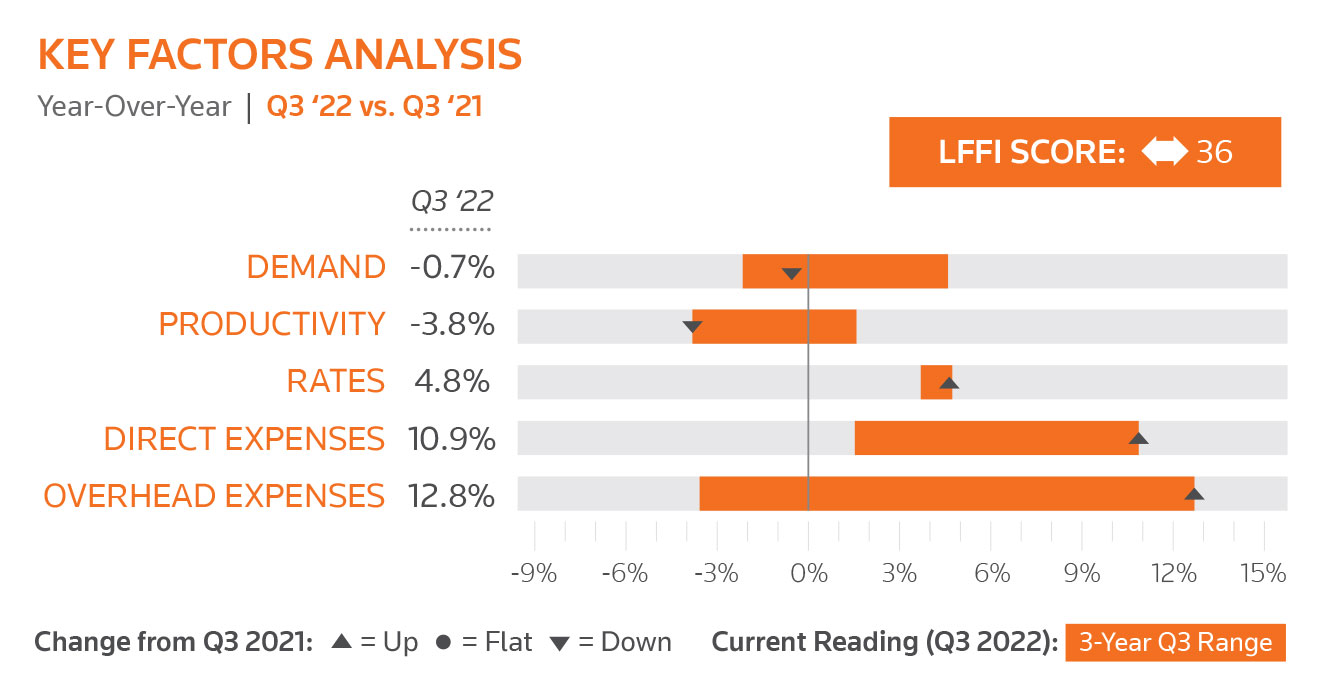

LFFI is a composite index of law firm market performance using real-time data drawn from major law firms in the United States and key international markets. So far in 2022, the quarterly reports provided insights on how ongoing economic uncertainty and questions about operating in a post-pandemic world were affecting law firm profitability.

The Q1 2022 report was among the early indicators that law firm growth in demand and rates would have difficulty matching the strong performance of 2021. In addition to tough year-over-year comparisons, law firms also had to deal with surging expenses. In coverage of the report for Above the Law, Joe Patrice noted: “Sure, expenses are way up — a combination of associate salary bumps and the return of travel expenses largely absent over the last couple years, but firms are still thriving. Thomson Reuters put out its latest Law Firm Financial Index (check out the full report by signing up here) — the artist formerly known as the Peer Monitor Index for folks who’ve followed this for a while. And while the LFFI continues to reflect a market with sound fundamentals, there’s some risk on the horizon.”

In the coming months, law firm profitability continued sliding as demand cooled off and expenses rebounded. By the release of Q2 2002 report, the index had fallen for the fourth consecutive quarter – the longest such slide in its history. The Q2 report generated worrisome headlines, including ‘Early Warning’ Over Law Firm Profits Comes as Demand Drops from ALM’s Andrew Maloney and Law Firms Facing Worst Financial Conditions in Years – TR Data from Artificial Lawyer.

Yet legal sector analyst Jordan Furlong noted a bright spot: an uptick in legal tech spending. In a series of tweets, Furlong emphasized the significance of firms investing in technology: “Spending on tech is something law firms have been urged to do for nearly two decades. Consultants have been virtually begging firms to move on this. And when firms finally do, suddenly it’s, ‘Oh [no], expenses are up, profits are down!’” He added, “Law firms are doing exactly what they ought: Investing in technology today to reduce expenses and increase efficiency, effectiveness, and profitability down the line. It’s the ultra-rare example of firms thinking more than one fiscal quarter ahead.”

The following months saw law firm profitability continue to drop from the combination of falling demand and surging expenses, the Q3 2022 report showed. In analysis of the Q3 data, Isaac Brooks, Thomson Reuters senior analyst, noted that legal work was moving down-market: “it all seems to provide strong evidence that clients have begun shifting their legal work to lower priced firms, such as midsize law firms, and are likely to continue doing so into the future as more and more corporate law departments look to do more with less.” On social, Ron Friedmann noted the data and analysis helps “tell Q3’s shifting demand story.”

As the end of the year approaches, law firm leaders remain under pressure amid concerns of a potential recession. With an uncertain outlook for 2023, it’s difficult to gauge what’s ahead for law firms.

The upcoming Q4 2022 report will be issued in February 2023.