Fourth Consecutive Quarter of Decline for Thomson Reuters Law Firm Financial Index

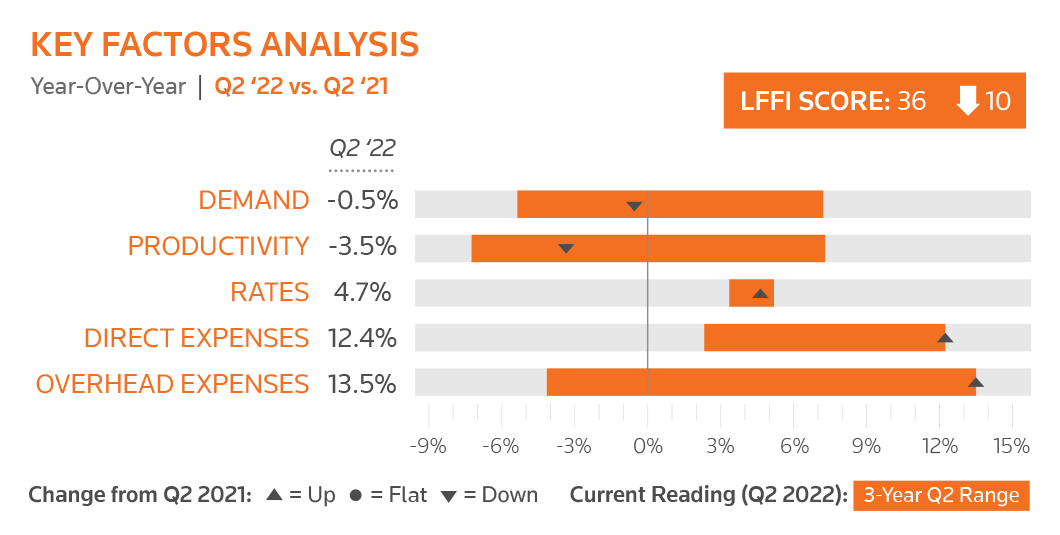

Law firm profitability continues to slide due to an inevitable cooling off in demand and a rebound in expenses, according to findings of the Q2 2022 Law Firm Financial Index, released today by Thomson Reuters. Powered by Peer Monitor/Financial Insights, the index fell for a fourth consecutive quarter – the longest such slide in its history.

Legal Current shares three takeaways from the Q2 2022 index.

- Rate growth remains robust. Rates and realization continue to be strong, which helps support firm profitability. Yet they’re not enough to offset expenses growing at a double-digit pace.

- Demand is declining as expenses soar. Demand for law firm services slipped 0.5% compared with a year ago as corporate work, which drove much of the growth seen in 2021, fell 0.7%. The decline was even more pronounced for corporate mergers and acquisitions work, which dropped 4.9%. Meanwhile, expenses surged due to a combination of inflation, competition for talent, and firms moving to hybrid or in-office working arrangements. Direct expenses rose 12.4%, and associate compensation, especially for Am Law 100 firms, was the principal driver. Overhead expenses grew 13.5% as firms restored more staff functions, such as recruiting and business development, that were cut during the depths of the pandemic.

- Firms are investing heavily in technology. Technology spending grew at its fastest pace in eight years, with growth averaging 10.5%. The report notes the growth “suggests that firms are not simply spending more due to inflation, but that they are making longer-term investments.”

The report concludes, “having hit its lowest all-time score, [the index] serves to warn firms that they must keep a tight grip on the steering wheel now as future revenue tries to measure up against a spectacular second half of 2021.”

Produced by Thomson Reuters, the Law Firm Financial Index is a composite index of law firm market performance using real-time data drawn from major law firms in the United States and key international markets.

For more insights, download the report.