Thomson Reuters Law Firm Financial Index Q1 2022: Three Takeaways

Law firms will be challenged to surpass the high bar set in 2021, according to findings of the Q1 2022 Law Firm Financial Index, released today by Thomson Reuters. The index, powered by Peer Monitor/Financial Insights, showed law firm growth in demand and rates were no match for surging expenses.

Legal Current shares top takeaways from the Q1 2022 index, which showed law firm profitability dropped dramatically due to higher expenses.

1. Demand and rates continued to grow. In the first quarter, demand was up 2.7% compared with a year ago. Real estate practices were strong. Litigation was up 2.2%. Corporate practices also saw a 2.2% gain, despite a 5.7% decrease in M&A work, which powered much of the law firm market’s gains throughout 2021. Meanwhile, worked rates were up a solid 5.0%.

2. Lawyer compensation continued to rise sharply. Associate compensation rose 12.1%, and for Am Law 100 firms, was up 17.3% in the first quarter. The increasingly expensive competition for talent, combined with a rebound in overhead expenses after last year’s steep cuts, took a toll on law firm profitability.

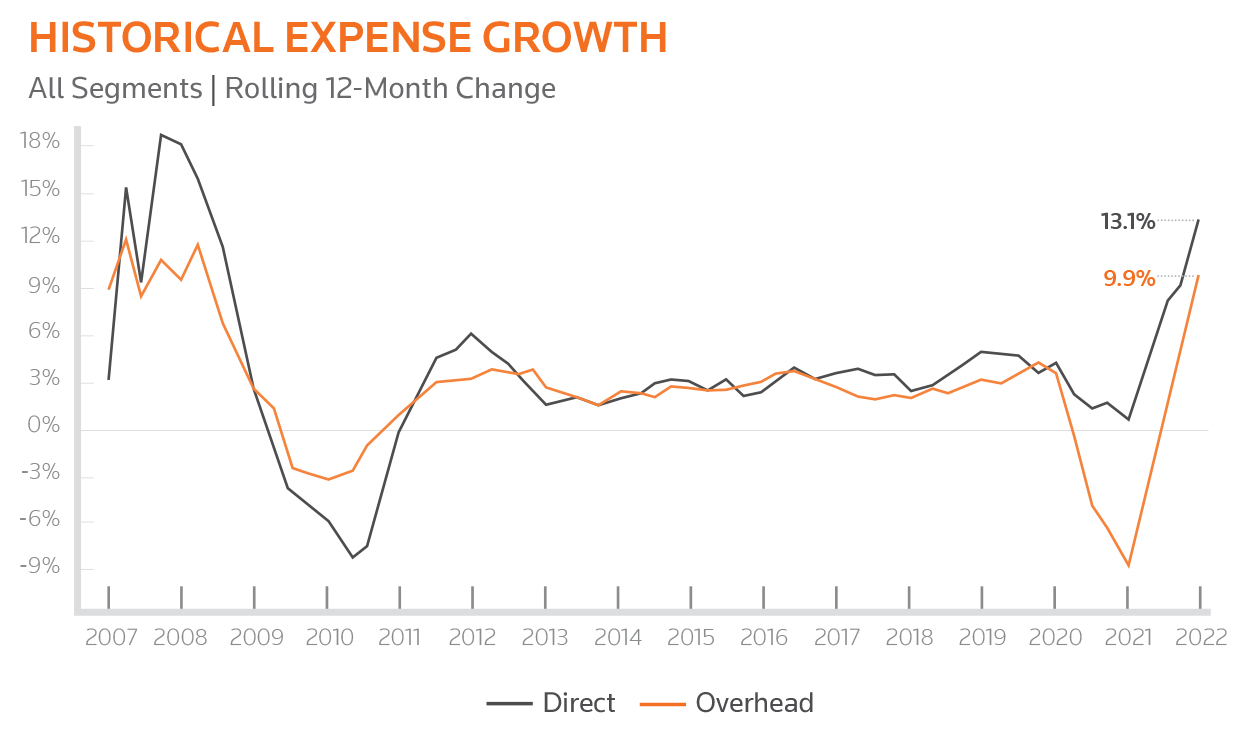

3. Overhead expenses surged from 2021 lows. Direct expenses shot up 13.1% in the first quarter. Overhead expenses rose 9.9%, driven by huge increases in recruiting, marketing and business development, and office expenses – three areas that saw some of the steepest declines in spending during the depths of the pandemic. Still, overhead expenses per FTE remain below pre-pandemic levels.

Particularly when it comes to expenses stemming from competition for talent and rising overhead, the report concludes, “indications are that we likely have not seen the last of these complex shifts.”

Produced by Thomson Reuters, the Law Firm Financial Index is a composite index of law firm market performance using real-time data drawn from major law firms in the United States and key international markets.

For more insights, download the report.