Top Concerns of Small Law Firms: Administrative Tasks and Business Development

Lawyers at small law firms are increasingly concerned about the administrative burden placed on them and the impact it has on their ability to practice law, according to the 2021 State of the U.S. Small Law Firms Report. Released today by Thomson Reuters, the report revealed that spending too much time on administrative tasks is small firm lawyers’ top challenge.

The finding is a departure from reports in prior years. In 2020 and earlier, small firm lawyers said their top challenge was acquiring new client business. Notably, this concern over business development – a years-long trend – did not actually decline this year but fell to a close second spot on lawyers’ list of challenges.

Small firm lawyers’ frustration at spending time on administrative tasks – rather than practicing law – has been building for years. This year, the time small firm lawyers spent practicing law dipped to 56% – a new low – down from 60% just a few years ago. This is critical because practicing law is the part of lawyers’ days for which their clients are willing to pay them.

Yet the report showed that despite the challenges facing small law firm leaders, they generally view their firms as successful; 88% of respondents characterized their firm as “successful” or “very successful.”

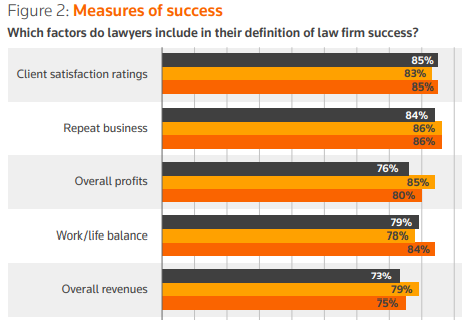

In terms of how small firms are measuring their success, the top three measures included repeat business (86%), client satisfaction ratings (85%), and overall firm profits (80%). A fourth measure – work/life balance – is notable for an uptick; 84% of respondents stated that work/life balance was part of how they measure success, the highest percentage ever reported for this measure.

The jump is likely pandemic related; as courtrooms shut down and law offices pivoted to remote work, lawyers discovered new ways of working. Small firms using work/life balance as a measure of success is likely attributed to lawyers’ preference for less travel, more flexibility with remote working, and greater autonomy in setting working hours.

On the other end of the spectrum, a noteworthy decrease comes in looking at the effects of 2020: a big drop in the number of firms worried about getting paid by clients. In 2020, 64% of respondents said getting paid posed at least a moderate challenge; in 2021, only 41% indicated it’s a moderate challenge.

The report examined how firms address their payment problem. They implemented changes including increasing and monitoring billing rates, increasing retainers, improving payment collection, accepting debit or credit cards, and accepting ACH payments. Some of these steps may also address the top challenge identified this year – spending too much time on administrative tasks – since making it easier for clients to pay their bills means less time for lawyers to spend attempting to collect unpaid invoices.

Yet the report found 44% of respondents don’t have a plan for addressing the problem of inefficient administrative workflows. A more encouraging metric: 59% of respondents said their firms support experimentation and innovation.

Those willing to adopt technologies for tasks such as document management and automation or eBilling can improve operational efficiencies and, in turn, decrease the amount of time spent on administrative tasks.

“Reevaluating business priorities and implementing technologies will require substantial degrees of change. I’ve seen small firms effectively drive change before, and alleviating the administrative burden is vital for firms’ continued growth and success,” said Mark Haddad, general manager, Small Law Firm, Thomson Reuters. “Firms that prioritize the needed investments and work to adopt technologies will be best positioned for success and at a competitive advantage over those stuck in the status quo.”

As the firms that addressed their payment problem have shown, those that implement technologies and make changes to their operational practices are well positioned for future growth.

For more ways small firms can drive improvements, download the 2021 State of U.S. Small Law Firms Report.