Three Takeaways from the State of the UK Legal Market 2022 Report

The percentage of corporate clients planning to increase their outside legal spend is at a five-year high. That’s among the key findings of the State of the UK Legal Market 2022, published today by Thomson Reuters.

The survey of corporate buyers of UK legal services combines research of more than 265 senior corporate counsel and stand-out private practice lawyers with the financial results of 29 global firms – both U.S.- and UK-based – with operations in the UK. Legal Current examined the report and is highlighting top takeaways.

3. Corporate clients expect to increase their UK legal spend this year as legal priorities shift. The average corporate buyer of UK legal services spends £10 million (US$13 million) on outside legal services annually – compared to a global average spend of £14.6 million ($19.9 million). Helping fuel the anticipated increase is a shift in corporate legal priorities as businesses emerge from the depths of the pandemic. While COVID-related issues remain the top legal priority, other key legal needs include dealing with complex and changing regulations, such as those related to the aftermath of Brexit, along with helping manage company growth. The global economic recovery is also driving legal spend in the UK; 70% of global multinationals report having legal needs in the UK, up from 68% a year earlier.

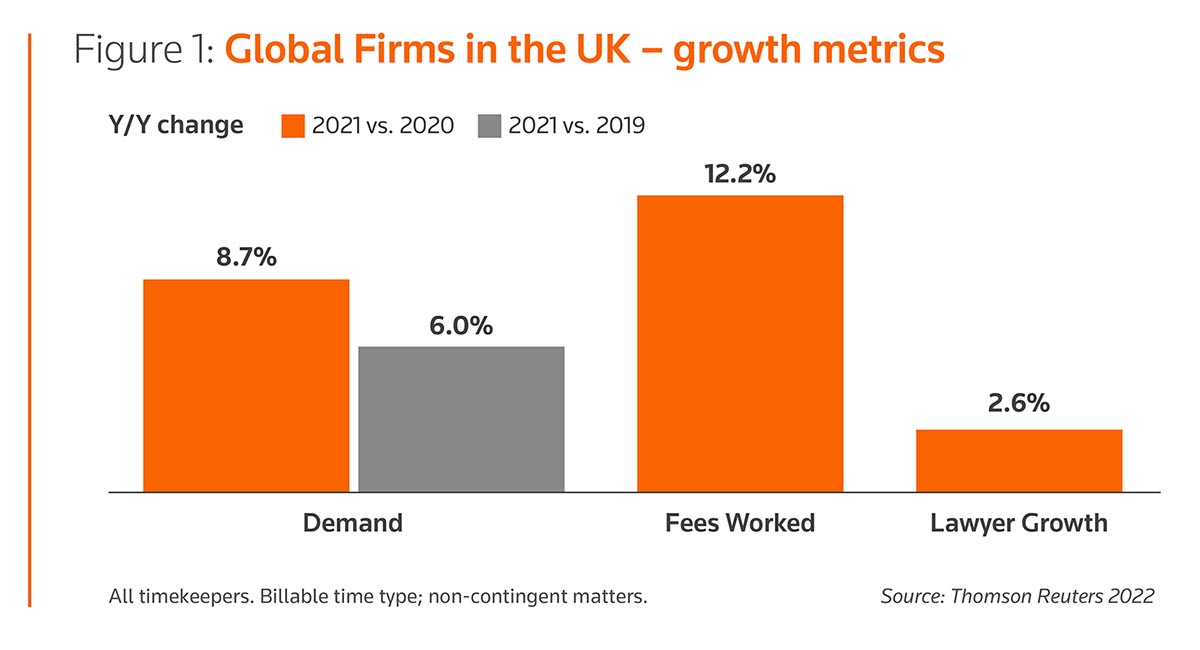

2. The UK legal market has resumed a growth mode. UK demand for legal services for global firms grew 8.7% in 2021 compared with 2020. Compared with 2019 – the last pre-pandemic year – demand was up 6%. Another positive performance measure was the growth in fees worked (worked rates, multiplied by billable hours); it showed 12.2% growth in 2021 compared to 2020. All are good signs for the health of the market going forward.

1. Understanding clients’ businesses and use of technology are key to client favorability. Clients report that a deep understanding of their business is the most important skill for their law firms to have. Clients also indicate they want their firms to have competency in legal technologies, including artificial intelligence. Less than a quarter of corporations surveyed that use UK firms are currently using technologies such as legal analytics, AI-driven smart contracts or legal project management. It underscores how law firms need to demonstrate skills and drive efficiencies to meet their clients’ shifting demands.

For more insights on the UK legal market, download the full report.