Thomson Reuters Q4 2021 PMI: Strong Performance Tempered by Increasing Expenses

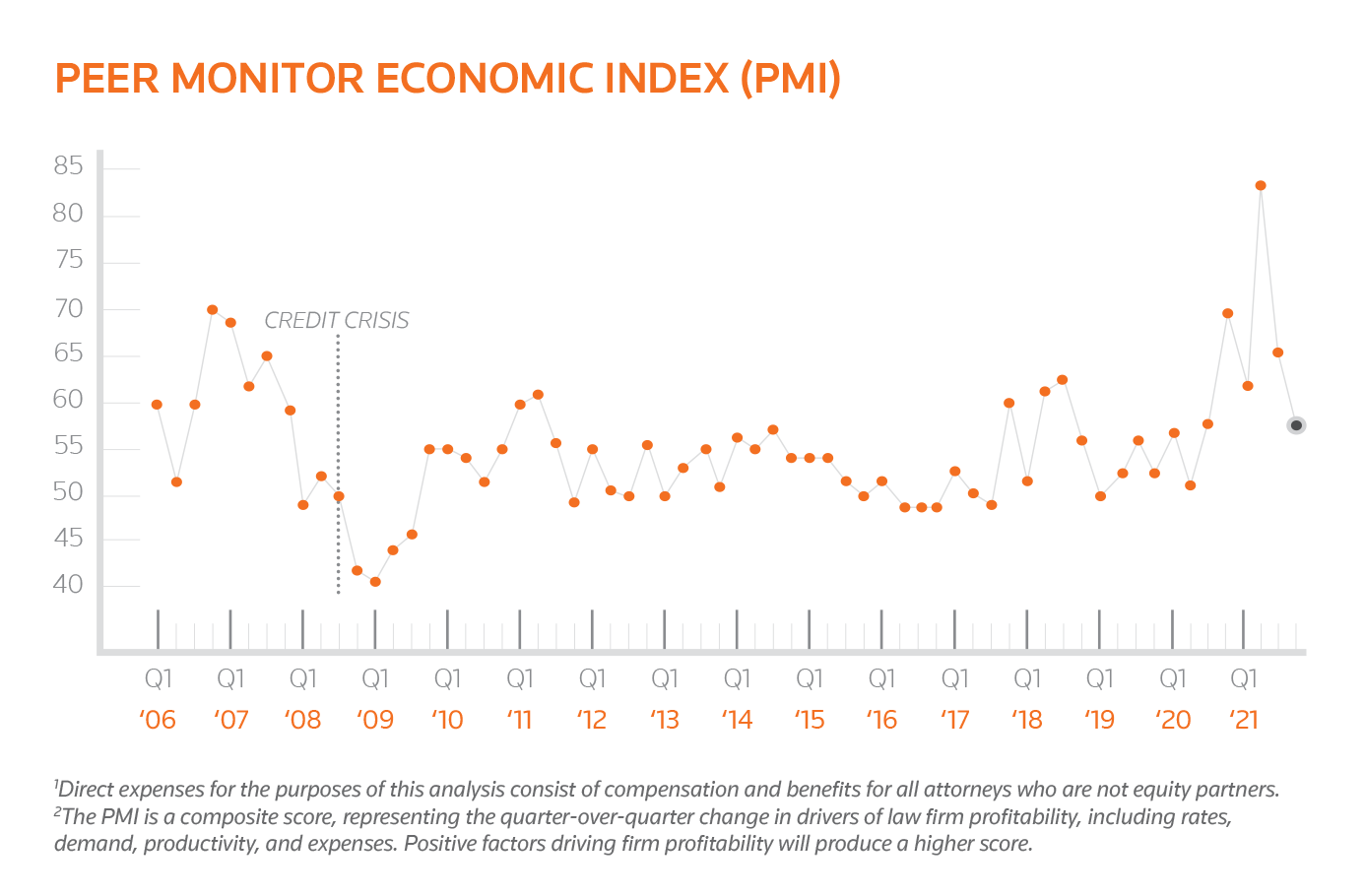

Last year closed with strong performance across key law firm metrics – including demand, rates, and productivity – but the positives were tempered by the intense talent war driving up compensation costs, according to the Thomson Reuters Peer Monitor Economic Index (PMI), released today. The fourth-quarter 2021 PMI, a composite index of law firm market performance, came in at 58, a slight drop from the third quarter

Demand was up 4.2%, compared to the same time in 2020, with growth across nearly all major practice areas, led by real estate, which was up 11.3%. Corporate, M&A, and tax practices also posted strong performances in Q4 and for the full year.

The Q4 worked rate growth dipped slightly but remained a healthy 3.6%. This dip, combined with large jumps in both direct and overhead expenses, offset the three-year high in Q4 demand growth and strong productivity growth.

The report explored the factors contributing to the upticks in expenses, predicting 2022 will be “the year of talent.”

Overhead expenses increased 5.8%, with growth driven by big jumps in technology, office, and marketing expenses. The increase in office expenditures is notable because many firms have yet to implement full return-to-office plans, indicating these expenses may continue to grow. Likewise for marketing and business development expenses as spending on conferences and client visits is just beginning to ramp back up.

Direct expenses grew a strong 8.4%, driven by firms’ continued aggressive hiring and growth in associate compensation. The report emphasized that the increase in associate compensation has not yet led to a decrease in attorney turnover rates.

The report concluded: “Going forward, law firms may struggle to justify these costly associates, especially if they have only a short tenure.”

Download the Q4 2021 PMI report, and learn more about Peer Monitor here.