Second Straight Year of Growth for Large Law Firms

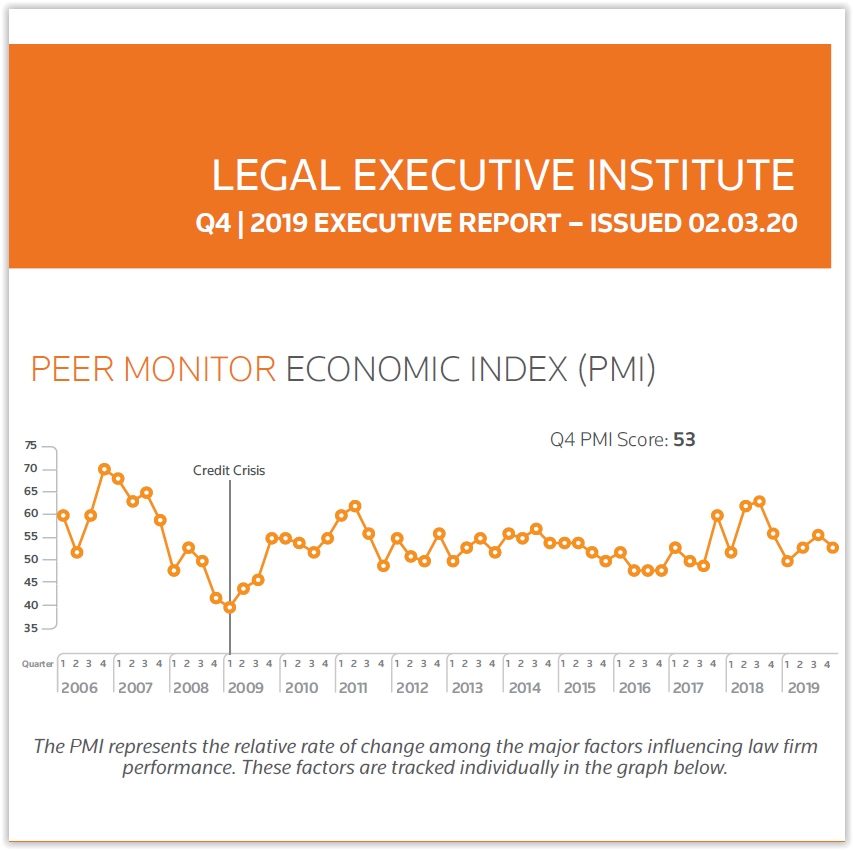

The large law firm market notched a second straight year of growth in 2019, according to the latest Peer Monitor report.

Firms wrapped up what is arguably their best two-year period since the end of the recession, 2019 marked the first two year stretch in more than a decade where demand for law firm services rose by at least 1 percent each year. In addition, rate growth has been strong, helping to boost revenues.

Large law firms finished the year strongly. In the fourth quarter, demand grew 1.1%, and worked rates rose 4.0% — the highest rate growth since 2011. However, productivity dropped 1.1% because of high headcount growth.

For the full year, demand was up 1.0% — the same as 2018. Rate growth, meanwhile, was significantly higher in 2019, up 3.8%, compared with 3.2% the year before.

Much of the growth has been fueled by strength in litigation and transactional practices, which together make up nearly two-thirds of large law firm billings. Demand for litigation rose 0.8% in 2019, which was slightly less than the 1.3% in 2018, but still represented two consecutive years of growth. Transactional practices — corporate, real estate and tax work — had their third strong year in a row, up 1.8%, compared with 1.5% in 2018 and 0.5% in 2017.

Productivity and expenses, however, dragged down profitability in 2019. Overhead expenses grew 4.8% in Q4, one of the highest levels seen in recent years. Productivity declined 1.0%, as firm accelerated hiring. Headcount grew 2.0% in in 2019 — more than double the rate in 2018 and one of highest levels of hiring in the last decade.

The Peer Monitor report echoed many of the recent findings of the recent 2020 State of the Legal Market from Georgetown Law and the Legal Executive Institute, which concluded that “during 2019, most U.S. law firms continued to perform reasonably well in the face of challenging market conditions.”

“2019 may have been an even better year for large law firms in many regards than 2018 was,” said Mike Abbott, vice president, Market Insights and Thought Leadership, Thomson Reuters. “Growth was widespread across market segments, practice areas and geographies. And firms were able to regain some measure of pricing power. But competitive pressures and demands from clients for even greater efficiency remain. We’re seeing many firms take advantage of current conditions by investing in innovative technologies and business models to enhance their competitiveness moving forward.”