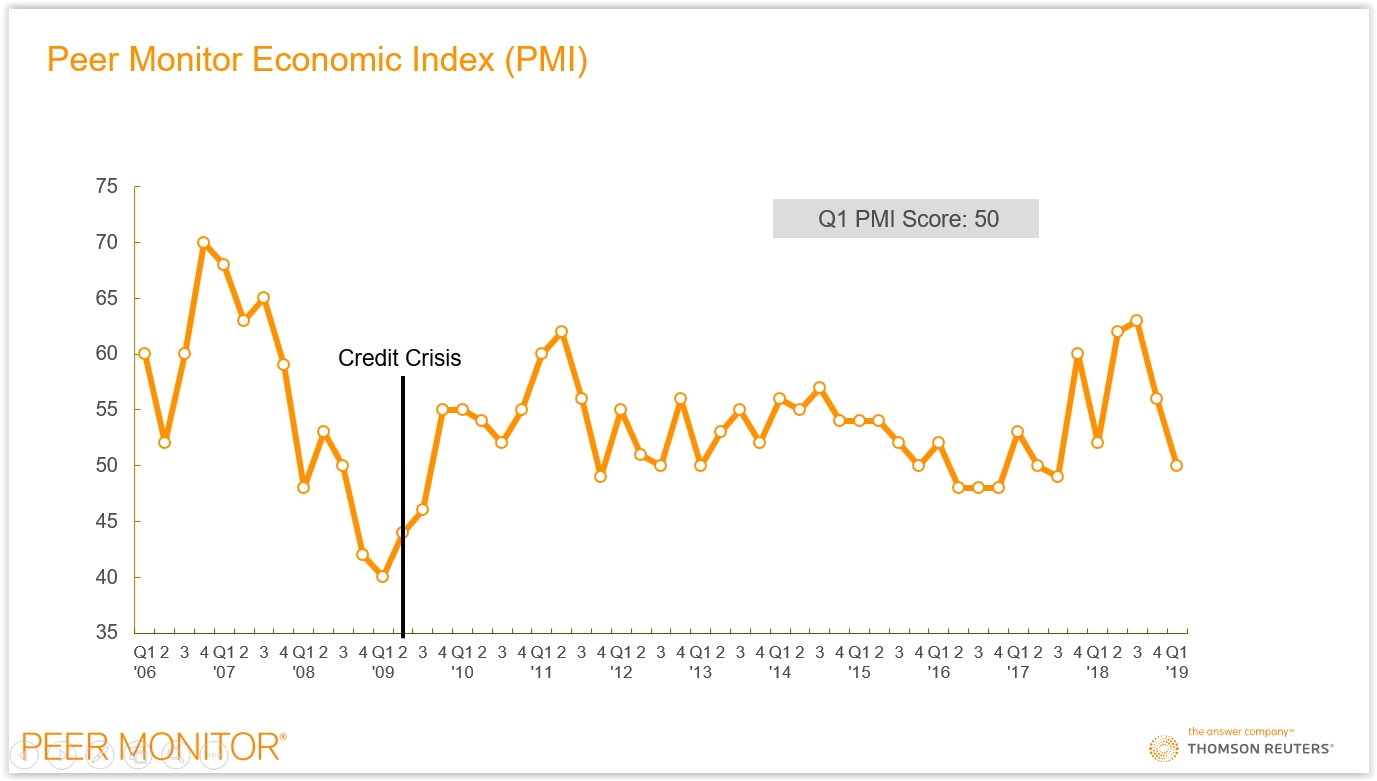

Law Firm Rates Up But Demand Flat in Q1: Peer Monitor Index

While large law firms saw the strongest rate growth in several years in the first quarter, demand growth was flat and productivity fell. The combination dropped the Thomson Reuters Peer Monitor Economic Index (PMI) by six points to 50.

Demand for large law firm services slipped 0.1%, however, that was largely a result of weakness among Midsize firms. Demand was up by an average of 1.2% for Am Law 100 and up 0.2% for Am Law Second Hundred, but fell 1.0% for Midsize.

Among practice areas, litigation work was flat after growing for most of 2018. Transactional practices were mixed — corporate work gained 0.2%, but real estate was down 0.8% and tax work fell 2.1%. IP practices were also down.

Worked or negotiated rates were generally strong across the board in the first quarter, up an average of 3.8% — the highest quarterly figure in more than six years.

Productivity fell 1.8% as firms accelerated headcount growth, producing an imbalance between supply and demand.

“After a fairly robust 2018, it’s not entirely surprising that the large law firm market has a more mixed first quarter,” said Mike Abbott, vice president, Enterprise Thought Leadership and Content Strategy, Thomson Reuters. “While the overall market had somewhat soft demand, the market segments comprised of larger firms saw relatively stronger demand. There is still plenty of runway left for 2019, and the true test will be whether firms can stimulate demand, maintain price integrity and balance capacity against demand to put themselves on a better track for the remainder of the year.”

A copy of the Q1 2019 PMI report can be downloaded here.

For more information on Peer Monitor, visit http://legalsolutions.thomsonreuters.com/law-products/solutions/peer-monitor.

The PMI, produced by Thomson Reuters, is a composite index of law firm market performance using real-time data drawn from major law firms in the United States and key international markets. A PMI of 65 or greater indicates strong law firm market performance.