Fundamental Shifts Are Disrupting the Legal Market: New Georgetown Law & Legal Executive Institute Report

Clients are taking “decisive control” and moving the legal market to a more client-centric model that is driven by innovation and flexibility, delivering improved efficiency, predictability and cost-effectiveness. That’s the conclusion of the 2020 Report on the State of the Legal Market issued today by the Center on Ethics and the Legal Profession at Georgetown University Law Center and Thomson Reuters Legal Executive Institute.

According to Peer Monitor data, law firms saw a second consecutive year of increased demand and higher rates in 2019. But at the same time, the report says a fundamental shift is underway that is dramatically changing who performs legal work, how that work is done, and how it is priced. Increased emphasis is being placed on maximizing the value and efficiency of legal services through greater use of legal operations professionals, disaggregation of legal services including to non-law firm providers such as the Big Four and other alternative legal service providers (ALSPs), and innovative pricing strategies.

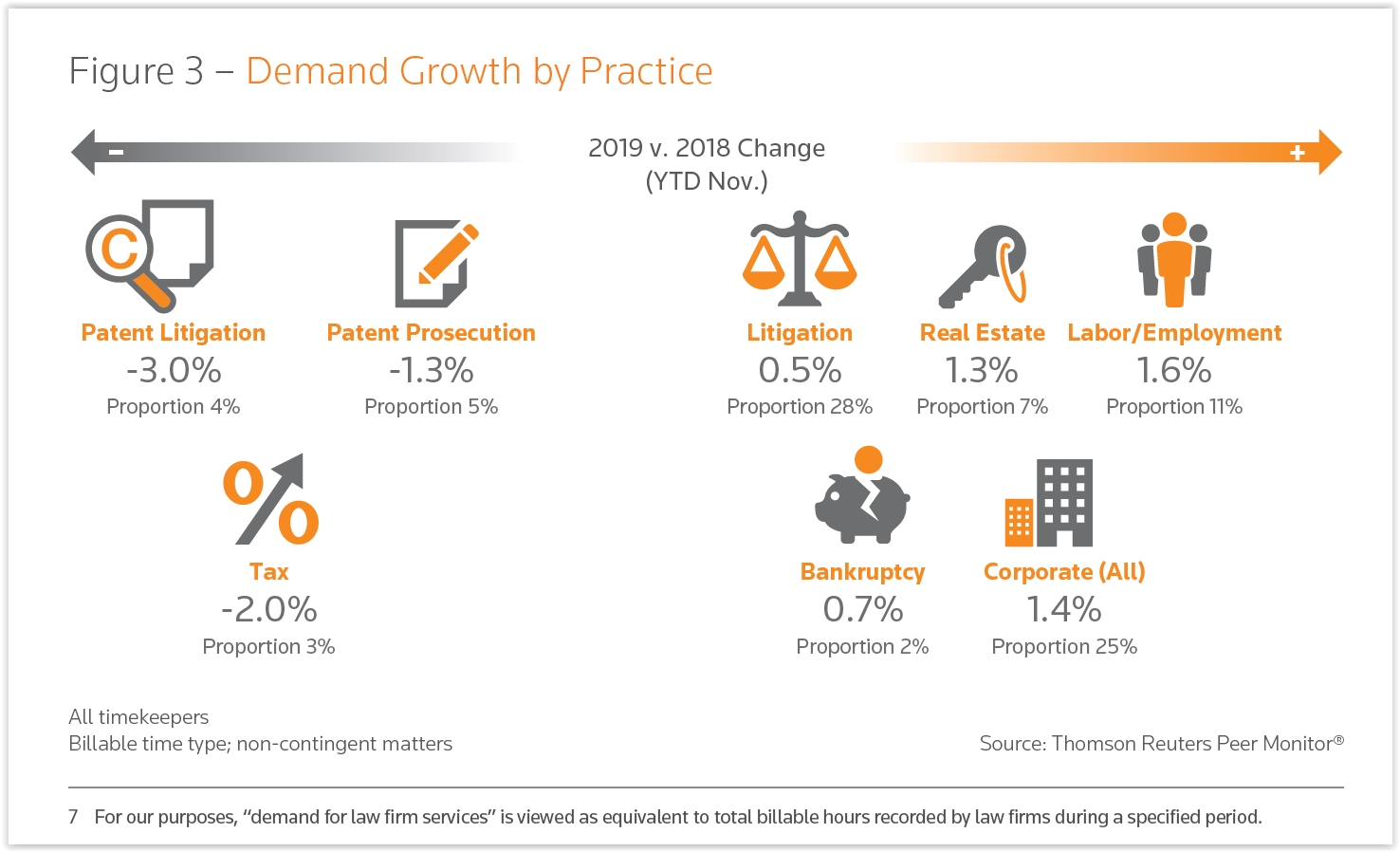

In 2019, corporate practices such as M&A, and litigation drove much of the growth. At the same time, law firms are responding to the shifting competitive environment by innovating in areas such as tying compensation and partner performance to efficiency and profitability metrics.

In 2019, corporate practices such as M&A, and litigation drove much of the growth. At the same time, law firms are responding to the shifting competitive environment by innovating in areas such as tying compensation and partner performance to efficiency and profitability metrics.

James W. Jones, a senior fellow at the Center on Ethics and the Legal Profession at Georgetown Law and the report’s lead author, notes, “We should stop referring to innovative services or delivery models such as alternative fee arrangements and alternative legal service providers as ‘alternatives. They are increasingly becoming the norms in replacing prior ways of providing legal services.”

Technology is helping drive much of the transformation. The report notes that the pace of “technology-driven change has vastly accelerated within the last few years.” In addition, law firms are now leading much of that change. Mike Abbott, vice president, Enterprise Thought Leadership and Content Strategy, Thomson Reuters, said, “We’re seeing a trend towards more law firms launching their own software-development businesses, investing in legal tech startups and establishing technology incubators.”