Firms Reconsider How Technology Shapes Productivity as Law Firm Market Returns to Profitability

Law firms showed resilience in 2023, taking advantage of shifts in market demand and aggressively raising rates while exercising restraint in costs, particularly talent costs for associates. This balanced approach of managing for both topline growth and cost controls paid dividends for firms; if they continue to successfully execute on those strategies, the market is well positioned to potentially continue its profitability growth in 2024.

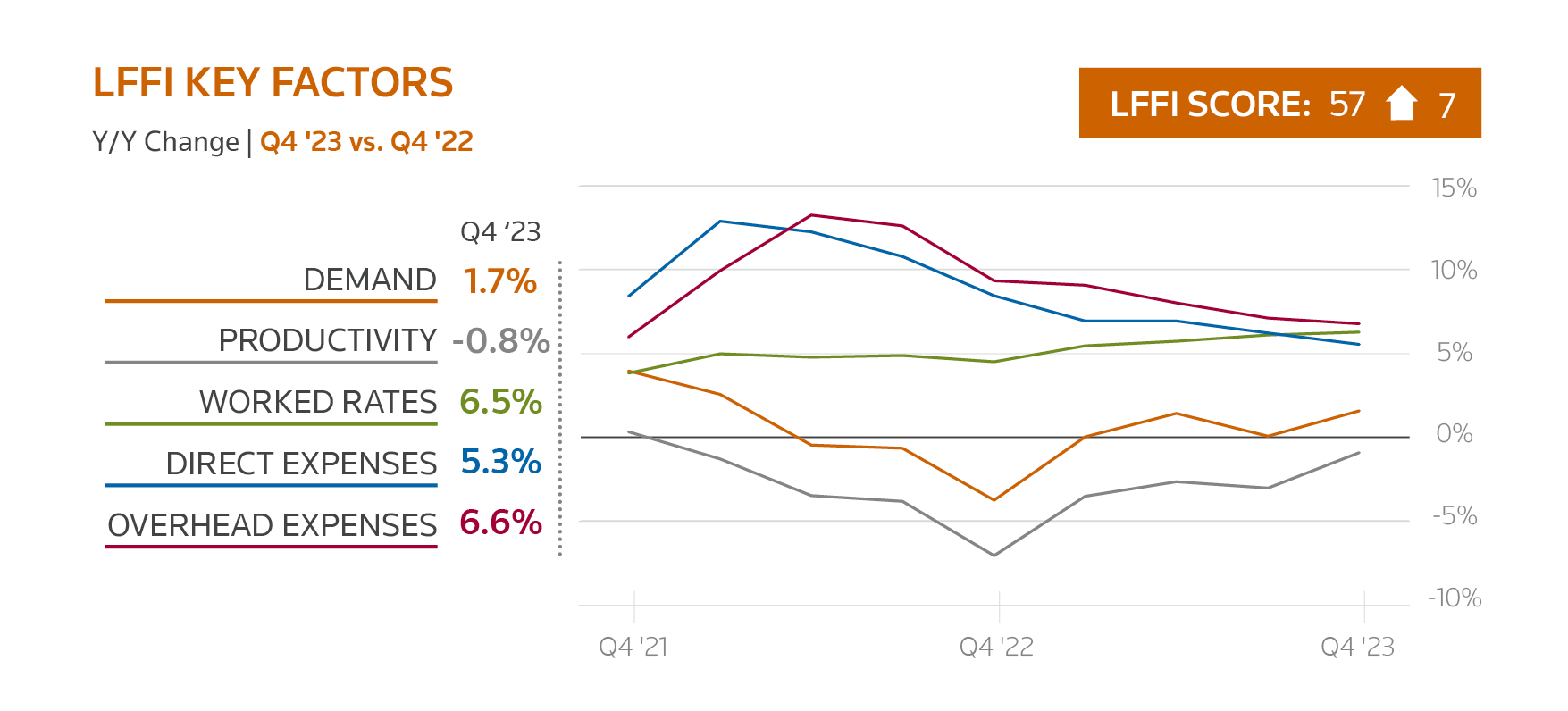

These are among the takeaways from a new report – the Q4 2023 Thomson Reuters Law Firm Financial Index (LFFI) – showing that the law firm market closed out 2023 strongly and returned to profitability, rebounding from a challenging 2022. The report noted that improved demand and slowing talent costs helped drive profitability amid questions about the impact of technology on productivity.

Of note, while productivity fell, it was the smallest decline since 2021. In addition, the report noted how “advances in technology have allowed lawyers to put more value in their hours,” even as billable hours per lawyer continue to drop. Generative AI could accelerate this trend and force firms to change how they evaluate the performance of lawyers as well as firms themselves.

Additional notable findings include:

- Firms significantly slowed their direct expense growth – after weathering costly competition for talent in recent years – by keeping salary growth and year-end bonuses in check, while reducing incoming fall associate classes.

- Demand was up by an average of 1.7%. The uptick was driven largely by growth in counter-cyclical practices, including litigation, bankruptcy, and labor & employment – practices that tend to perform better in challenging economies. The strength in counter-cyclical practices more than made up for weakness in transactional practices. Litigation saw its strongest quarterly performance in more than two years.

- Worked rates rose 6.5% in the fourth quarter. It’s the highest increase since the Global Financial Crisis of 2008-09.

The net result: the law firm market returned to profitability in 2023 after seeing profits contract in 2022. However, profits were not as strong as in 2020 and 2021, when profits-per-equity partner soared by double-digit percentages.

Finally, this year will likely bring more discussion about how generative AI will impact firm operations and lawyer productivity, as discussed in the Future of Professionals report, which found that 55% of legal professionals expect using AI will lower costs for firms and drive greater firm profitability.

This is a guest post from Tommy Williams, interim general manager, Global & Large Law Firms, Thomson Reuters.