Alternative Legal Services Providers 2023 Report: By the Numbers

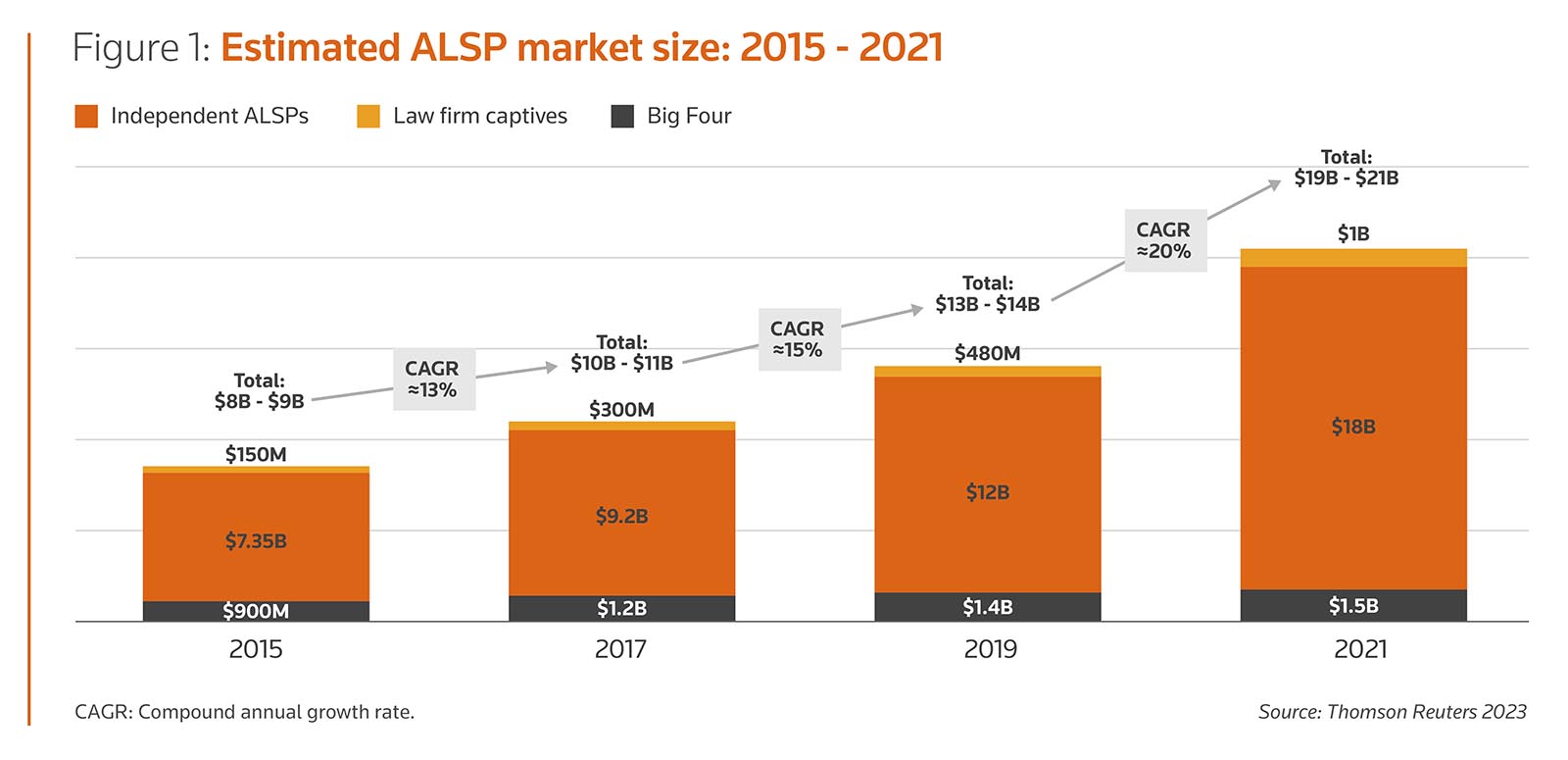

Alternative legal services providers (ALSPs) make up a $20.6 billion segment of the legal market and growth is accelerating dramatically, according to the Alternative Legal Services Providers 2023 Report. Legal Current shares a by-the-numbers look at top findings from the ALSP report, which is issued biennially by the Thomson Reuters Institute; the Center on Ethics and the Legal Profession at Georgetown Law; and the Saïd Business School, University of Oxford.

- 20% – ALSPs experienced a compounded annual growth rate (CAGR) of 20% from 2019-2021, a significant jump from the 15% CAGR from 2017-2019. The report notes that ALSPs are finding new ways to serve both law firms and corporate legal departments, and the boundaries between all three are becoming increasingly blurred.

- 26% – Among the largest law firms, 26% plan to increase spending on ALSPs. A growing percentage of law firms of all sizes expect to either maintain or increase their ALSP spend.

- 51% – More than half of large law firms (51%) use ALSPs for consulting on legal technology, which is one of the fastest-growing use cases. Most of the other top use cases for law firms have remained fairly steady, including e-discovery, legal research, litigation & investigation, and document review & coding. The most common uses for technology consulting are for outsourcing technology support, technology training, and learning about what legal technologies are available in the market.

- 87% – Independent ALSPs make up 87% – the largest segment – of the ALSP market. On the other end of the spectrum are captive ALSPs owned by law firms. They’re the smallest part of the market but also the fastest-growing – up nearly six-fold since 2015.

- $1.5B – ALSP services from the Big Four consulting firms account for $1.5 billion of the market, growing at 5% CAGR. The Big Four are the slowest-growing segment of the ALSP market.

Additionally, the report found the use of ALSPs is strongest in the United States for both law firms and corporations, ahead of the UK and Canada. However, usage varies; for example, legal research is the top use case in both the UK and Canada, with e-discovery being the top use case in the United States.

For more on how law firms and corporate legal departments are making the most of ALSPs, download the report.