Alternative Legal Service Providers Are Becoming Mainstream and Less “Alternative”

Alternative legal service providers (ALSPs) have accelerated their growth to a nearly $14 billion market share globally and are quickly becoming a mainstream segment of the legal market, a new study from Thomson Reuters Institute, the Center on Ethics and the Legal Profession at Georgetown Law and the Saïd Business School at the University of Oxford reveals. The report, Alternative Legal Service Providers: 2021 Report – Strong Growth, Mainstream Acceptance, and No Longer an “Alternative,” found that as competitive concerns diminish, law firms and corporate legal departments are increasingly open to partnering with ALSPs to stimulate growth and reduce costs.

Some key findings of the study:

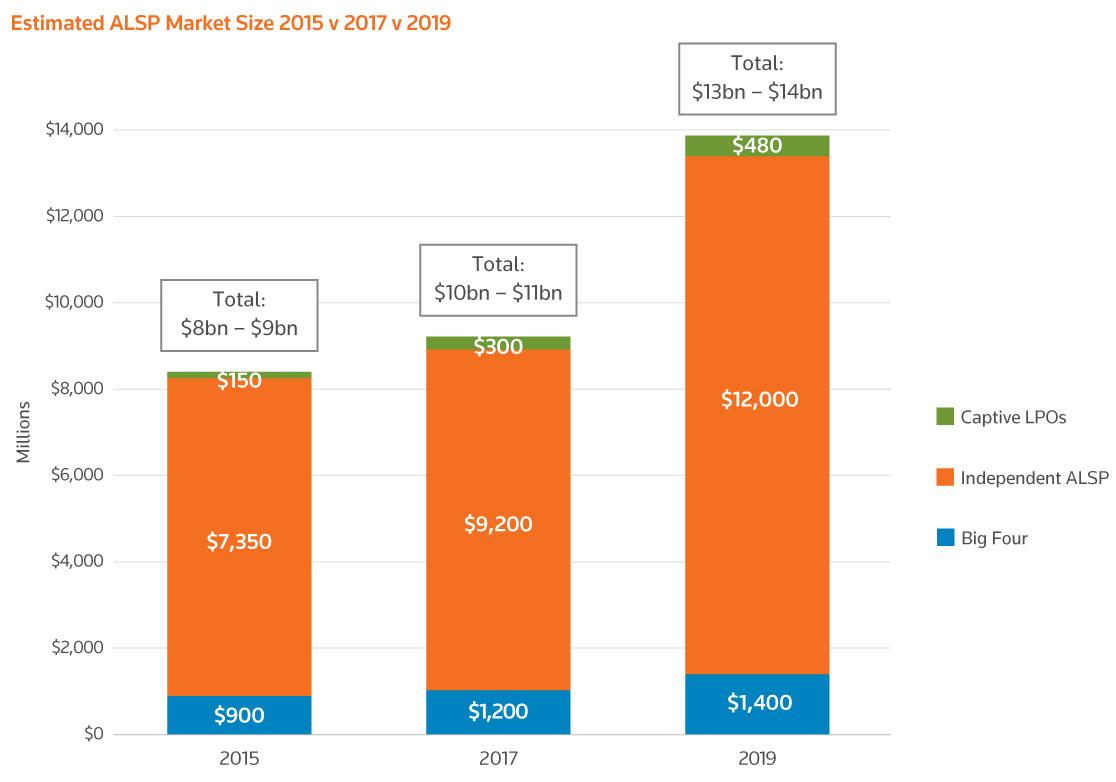

Growth has accelerated. With 79% of law firms and 71% of corporations using ALSPs – in order to reduce costs, improve efficiency and leverage cutting-edge technologies – ALSPs grew to an estimated $13.9 billion market for legal services by the end of 2019. It’s a marked acceleration compared with $10.7 billion market represented in the previous survey in 2017.

Law firm captives are growing fastest. While it’s the smallest segment of the ALSP market, the fastest growth has been among ALSPs that law firms formed as captive subsidiaries. It’s growing at a rate of about 30% a year as firms increasingly adopt a hybrid model to reap the benefits of ALSPs – such as cost reductions for clients – while retaining full control.

Objections and resistance to ALSPs are falling. Both law firms and corporations have “awakened” to the benefits of collaborating with ALSPs, rather than viewing them as competitors to law firms. They both increasingly realize how ALSPs can improve operational efficiency and reduce costs, while enabling firms to retain and even grow higher-value work.

The market is maturing and growing globally. As the ALSP market continues to expand globally, the report found differences in how ALSPs are used in different regions. Australian firms engage the broadest range of ALSP services, while UK firms, on average, use the least; U.S. and Canadian firms are in between. In addition, law firms and corporations expect to nearly double the average number of ALSP service lines they use over the next five years.

For more insights on the ALSP market, download the full report.