2023 Report on the State of the Legal Market: 10 Takeaways

A year of uncertainty awaits law firms, with multiple factors threatening profitability, including falling demand and productivity, rising expenses, shifting client outlooks, and inflation. These are among the findings of the 2023 Report on the State of the Legal Market, issued today by the Center on Ethics and the Legal Profession at Georgetown Law and the Thomson Reuters Institute.

The annual report relies on data from Thomson Reuters to review the performance of U.S. law firms, and it breaks down the factors that drive the need for firms to take a longer-range, more strategic view of their market positions. Legal Current shares 10 takeaways from the report.

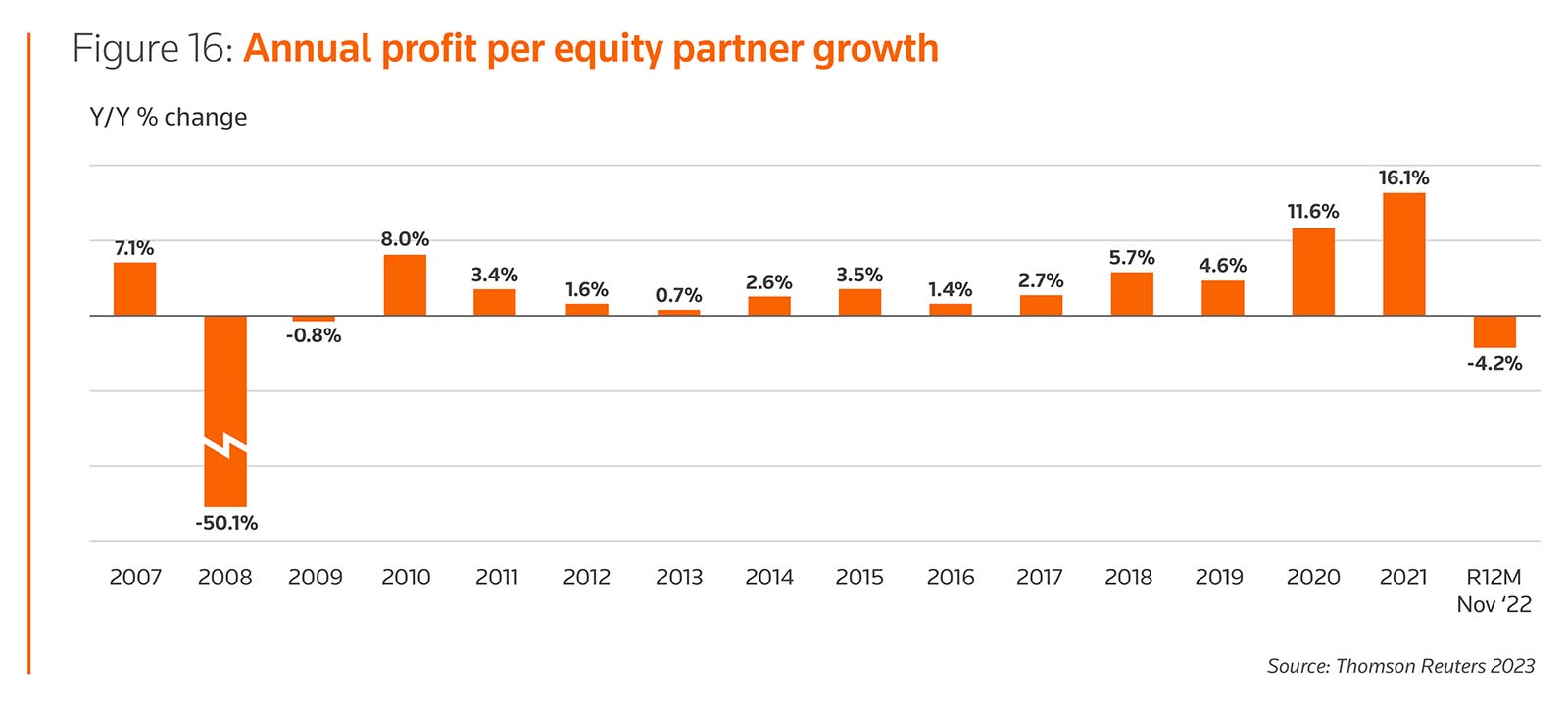

- Profits-per-equity partner (PPEP) are down. PPEP soared to record levels in 2021. But PPEP fell 4.2% for the 12 months ending November 2022. When financial books close for 2022, it will likely be the first full-year drop for PPEP since 2009.

- Threats to law firm profitability abound. The year ahead will likely involve multiple headwinds, such as slowing demand, less client spend optimism, higher expenses, falling productivity, weakening realization, and inflation.

- Midsize firms are showing strength. Midsize firms stood alone among the market segments in seeing demand growth in 2022. While larger firms saw stark deterioration in all practices, midsize firms were increasingly competitive, especially in litigation, labor & employment, and intellectual property.

- Demand is falling. Law firms saw a substantial slowing in demand for their services throughout 2022. Demand fell by an average of 0.1% in 2022 through the end of November, and will likely finish the year in negative territory, compared with the robust 3.7% rebound in growth for all of 2021.

- Transactional work is contracting. The report attributes the collapse in demand primarily to a sharp contraction in transactional work, such as M&A, brought about by growing economic uncertainty. This has particularly impacted larger firms, such as the Am Law 100, where demand has fallen “precipitously.”

- Productivity hit a record low. Falling demand and higher lawyer headcount combined to significantly reduce productivity. While average hours worked per lawyer has been steadily declining for more than 20 years, it fell sharply in 2022, reaching the lowest level ever recorded by Thomson Reuters Financial Insights, an average of 119 billable hours per month.

- Expenses are surging. Both direct and overhead expenses are rising at double-digit rates, the highest since 2009, as a result of factors including higher talent compensation, return-to-office expenses, business-development costs, and inflation.

- Inflation is hindering rates. While firms managed strong 4.8% growth in worked rates for 2022 through the end of November, it was largely overtaken by inflation. By comparison, the Federal Reserve’s personal consumption expenditures price index was up 5.0% through the same period.

- Collection realization is falling. After rising steadily for the previous two years, collection realization has begun to level out or decline across all segments of the market. The report suggests this could be due to firms losing their focus on billing discipline or clients pushing back on invoices and payment cycles, or both.

- Uncertain market conditions mean firms should analyze all aspects of their business. “Law firms need to closely examine all aspects of their business – including talent management, practice management, workflows, operations, and finances – and employ the necessary solutions and technology in order to successfully navigate the year ahead,” said Paul Fischer, president, Legal Professionals, Thomson Reuters.

Download the report for more insights and for strategies law firms can use to drive sustainable growth and long-term success.