2021 Highlights: Peer Monitor Insights into Law Firm Performance and Recovery

As 2021 comes to a close, Legal Current is looking back at the milestones and key accomplishments from the Legal Professionals business of Thomson Reuters. Today we revisit findings of the quarterly Peer Monitor Economic Index reports through the first three quarters of 2021 and the insights they provided into how law firms are recovering from the pandemic economy.

Early in the year, the Q1 Peer Monitor report showed encouraging signs for the law firm market. While demand for legal services dipped slightly, falling 1.0%, it was in comparison to Q1 2020 – a strong quarter before the economic impact of the pandemic fully took hold. Rate growth remained strong in Q1 2021, though slightly lower than in previous quarters, and productivity was nearly flat. The PMI score – a composite index of law firm market performance – was 62.

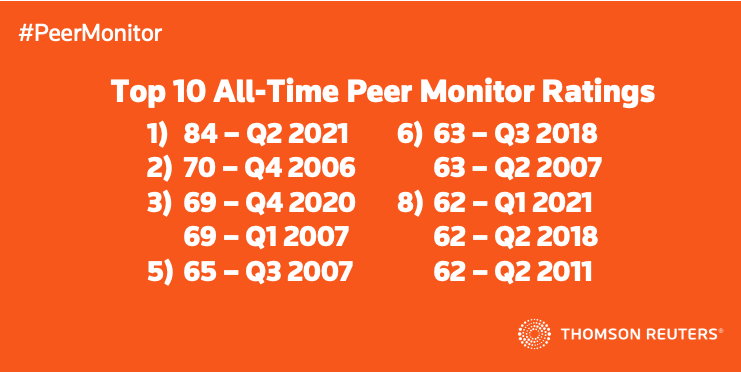

The PMI score soared 22 points to 84 – the biggest quarterly increase in the history of Peer Monitor – in the Q2 Peer Monitor report. The surge underscored the law firm market’s substantial recovery, with demand for law firm services rising above pre-pandemic levels as rates remained high, and many overhead expenses continuing to shrink.

Media coverage of the Q2 Peer Monitor findings in August was upbeat, including Bloomberg Law’s Roy Strom, who noted: “Law firms have two basic ways to grow their business. Work more hours, or charge more per hour. … The encouraging part of the pandemic recovery has been that it was driven by a surge in demand.”

In a sign of what was to come, Business Insider’s Jack Newsham emphasized the impact of the increase in demand on hiring: “Rising demand has prompted law firms to compete fiercely for talent. Dozens of firms have raised first-year lawyer salaries to $200,000 or more, and many said they’d pay bonuses — widely seen as retention payments — in the spring, summer, and fall. Meanwhile, young lawyers say they’re so burned out they’re reaching a breaking point.”

Newsham’s take played out in the Q3 Peer Monitor report, which showed the intensifying war for talent is becoming a drag on law firm performance, despite the law firm market’s continued strong recovery with growth in demand, productivity, and most practice areas. The Q3 PMI was 67 – the third-highest mark in the last decade.

In coverage of the report findings, Law.com’s Andrew Maloney noted: “Law firms are paying more for talent than ever before. But like other industries that’ve been hit by a so-called ‘Great Resignation,’ they’re also hemorrhaging it like never before, and the result is a diminished return on investment that could reach a ‘boiling point’ in the near future, according to the latest Thomson Reuters Peer Monitor Index report.”

At Above the Law, Kathryn Rubino concluded: “I’m sure Biglaw will be just fine in the long term, but it sure is interesting to find out just how much associate compensation is costing firms.”

Watch for the Q4 2021 Peer Monitor report in early 2022.