Large Law Firm Market Rebounded Slightly in Second Quarter

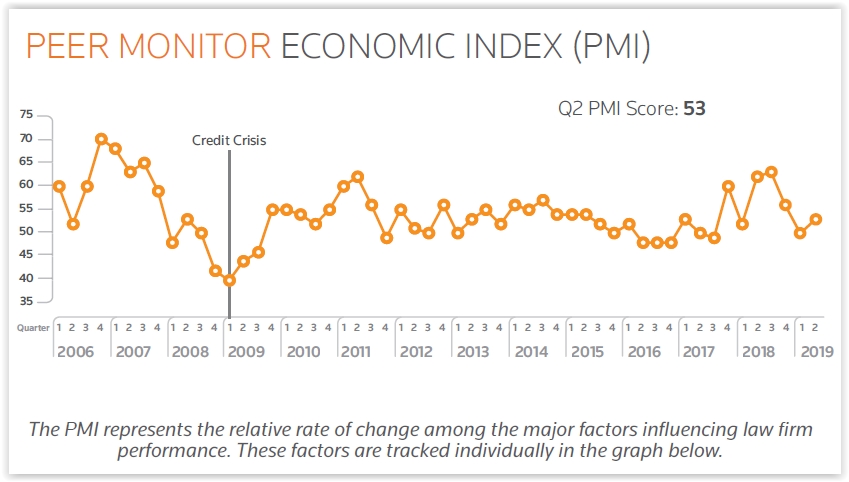

The large law firm market regained its footing somewhat in the second quarter. After a weak start to the year, demand rebounded in Q2 and rate growth remained strong, lifting the Thomson Reuters Peer Monitor Economic Index (PMI) three points to 53. However, productivity continues to fall, dampening profitability.

Demand for law firm services rose 0.7% in the second quarter, following a flat performance in the first quarter. Year-to-date, demand is now up 0.3%, comparable to the 0.4% seen through the first six months of last year.

Rate growth is much stronger this year, up an average of 3.8% both in the second quarter and year-to-date – this matches the first quarter for the highest mark in six years. At the same time, however, collected realization slid, dampening some of the positive impact of the higher rates.

Among the practice areas, litigation was up 0.3% in the second quarter, and is now up 0.1% year-to-date. Growth in litigation has eased this year following a strong performance in 2018. So far this year, litigation has been particularly strong for Am Law 100 and Am Law Second Hundred firms, and weaker for Mid-size firms.

Transactional practices were mostly stronger in the second quarter. Corporate work rose 0.7% and is up 0.4% year-to-date. Real estate was up 2.1% and is up 0.6% year-to-date. Tax work fell 2.3% and is down 2.2% year-to-date. Patent litigation was down 2.5% and is down 2.5% year-to-date. Patent prosecution fell 0.2% and is down 0.8% year-to-date. Labor and employment rose 1.6% and is up 0.6% year-to-date. Bankruptcy, which started the year strongly, retreated 1.2% but remains up 0.5% year-to-date.

Meanwhile, productivity fell for the third straight quarter, dropping 1.2% in the second quarter and is down 1.5% year-to-date. In contrast, productivity rose 0.9% in Q2 2018. Firms started accelerating hiring late last year, driving supply significantly above current demand. Headcount grew 1.7% in the second quarter, about the same as the first quarter. Headcount growth never exceeded 1.0% for any quarter last year.

While expense growth held steady in the second quarter, it continues to run near some of the highest levels seen over the last few years. Direct expenses were up 4.8%, similar to Q1, which makes it one of the highest rates since 2012. And overhead expenses rose 3.4% – one of the highest marks since 2016.

A copy of the Q2 2019 PMI report can be downloaded here.