“Tech spending remains especially hot:” Reactions to the Thomson Reuters Q1 2024 Law Firm Financial Index

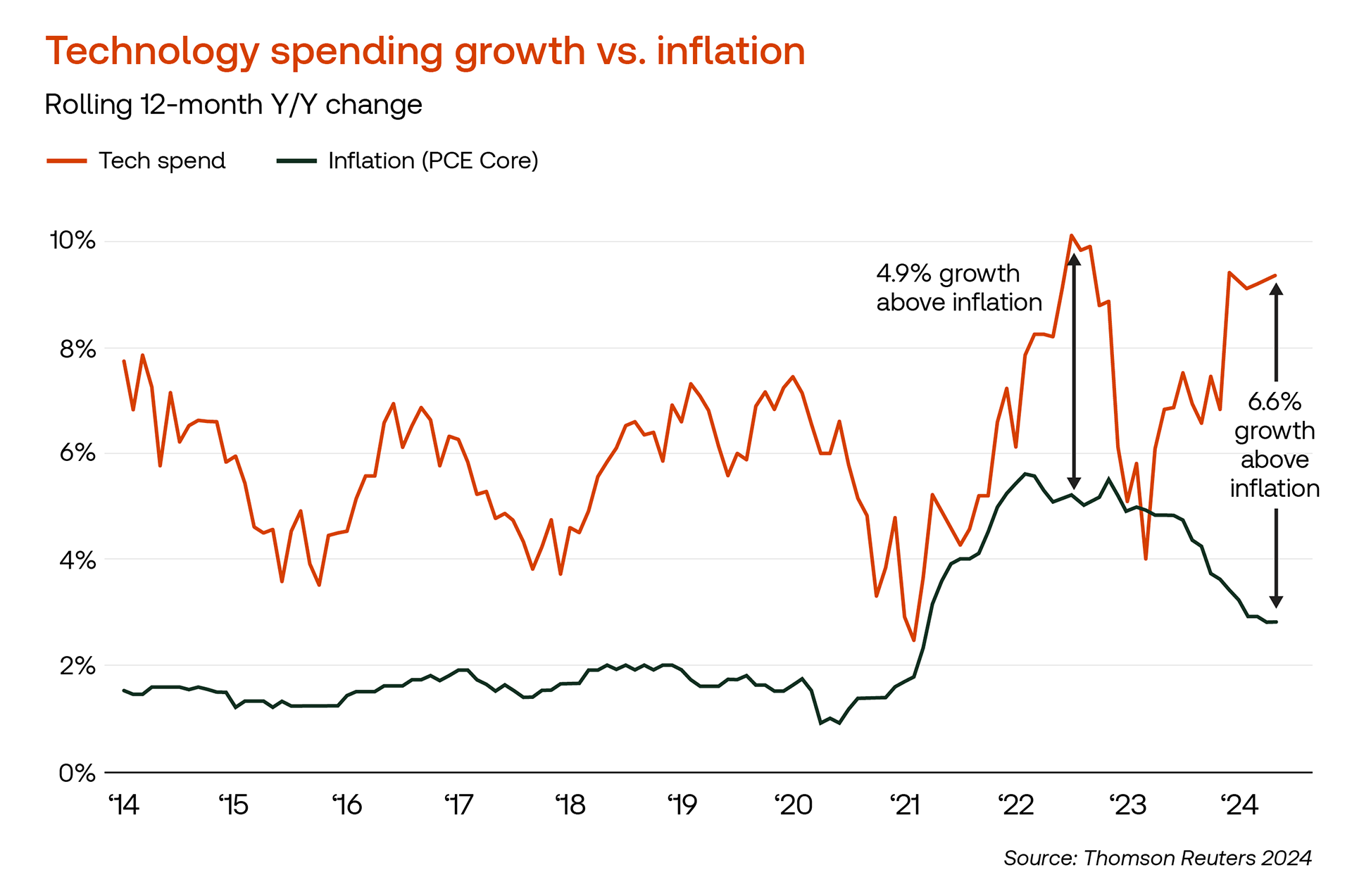

“While overhead expenses continued to cool during the first part of 2024, tech spending remains especially hot,” Andrew Maloney noted in Law.com’s coverage of the Q1 2024 Thomson Reuters Law Firm Financial Index. “Taking inflation into account, law firms are investing in technology at their most rapid pace since at least 2014, the report noted. Some of that, of course, is most likely related to artificial intelligence.”

Beyond how AI is shaping the legal space, journalists’ and bloggers’ coverage of the report, released Monday, emphasized firms’ revenue and profit gains in Q1 as well as the increase in demand for legal services. They also highlighted the continued rise in billing rates and litigation as the practice area driving growth in demand for law firm services.

Below are more highlights of the legal industry’s reactions to the report findings.

“Billing rates, which were a consistent bright spot for firms in 2023, continued to rise with a 6.6% increase in the first quarter compared with a year ago, according to the index,” Karen Sloan noted in Reuters.

Joe Patrice also called out the growth in firms’ billing rates in Above the Law, asking, “Now… will the firms collect on all those new year’s fees? Realization rates won’t be part of this equation until next quarter. So stay tuned.”

While noting the report included “[o]verall good news for firms,” he cautioned firms: “But don’t get cocky.”

Patrice flagged factors that could affect the “rosier outlook” for firms: “Demand could also be dragged down by the few flailing firms who’ve spent the last couple years looking around at everyone else rolling around on piles of money and asking, ‘but, guys, don’t you all want to do some layoffs?’”

In ABA Journal, Debra Cassens Weiss focused on the record-setting figures: “The first quarter growth in worked rates—the price that clients paid after negotiations—was 6.4% compared to the first quarter of 2023, setting a new high, according to the index report. Growth in real rates—which is rate growth adjusted for inflation—tied for the highest level since the financial crisis in 2007-2008.”

For more insights on the law firm market and how firms are investing in technology, download the full report.