“Embrace the litigators in your lives:” Reactions to the Latest Thomson Reuters Law Firm Financial Index

“Embrace the litigators in your lives” may sound like a Valentine’s Day lawyer meme, but it was Joe Patrice’s takeaway from the Q4 2023 Thomson Reuters Law Firm Financial Index.

Journalists’ and bloggers’ coverage of the report, released last week, emphasized how law firms’ profits rebounded in 2023, driven by rate growth and stronger demand for countercyclical work. They also noted the increase in profits per equity partner, the drop in lawyers’ productivity rates, and law firms’ efforts around expense management and headcount management.

Here are some highlights from the legal industry’s reactions to the report findings.

In Above the Law, Patrice pondered the counter-cyclical demand boom.

He concluded: “It might be more fair to say that the counter-cyclical units remained steady while everyone else freaked out. So, for now, embrace the litigators in your lives. They kept this ship afloat last year …”

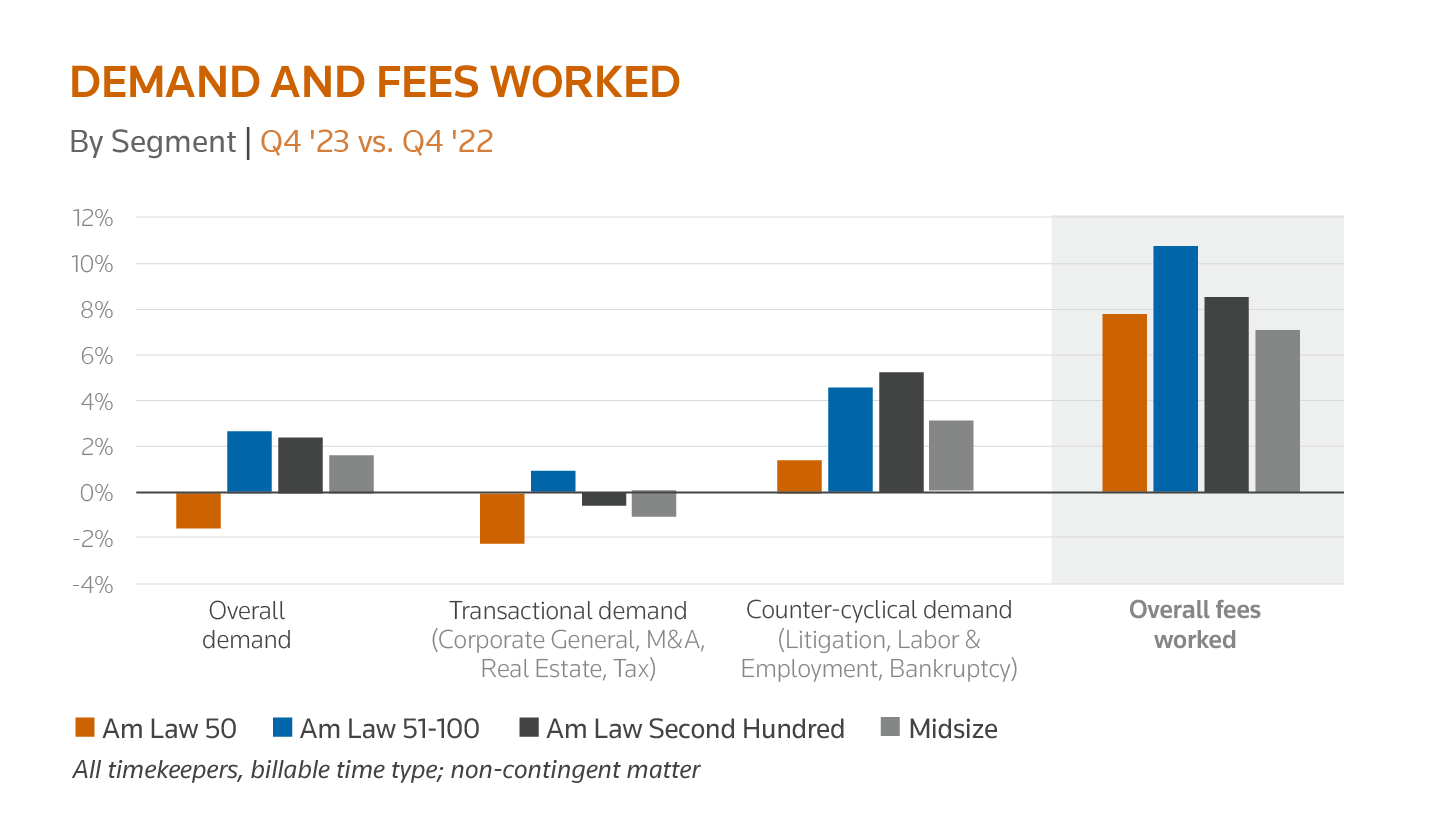

Karen Sloan agreed in her coverage for Reuters, noting “law firm demand was up nearly 2% year-over-year, but it varied significantly by practice.”

She added, “Demand for transactional practices remained stagnant in the fourth quarter, while demand for countercyclical practices, those areas that perform well in a rocky economy, was up: litigation demand rose 3%, and bankruptcy increased more than 6%, the index found.”

In Legal Dive’s coverage, Lyle Moran focused on the 6.5% increase in worked rates in the fourth quarter of 2023, noting it “was the highest quarterly increase since the Global Financial Crisis of 2008-2009, and the fourth straight quarter that a new post-crisis record was set.”

“Worked rates are the amount clients agree to pay to engage work on a matter, and the increase in law firm rates has sparked in-house legal teams to place a greater emphasis on outside counsel management,” Moran explained.

In Law.com, Dan Roe called out the impact of firms’ financial discipline around headcount management and rate hikes on profitability: “On a rolling 12-month basis, profits per equity partner rose 6% for the Am Law 100, versus 2.5% for the Second Hundred and 0.3% for midsize firms.”

Finally, Roe noted the continuing downward trend for hours worked per lawyer: “Following an uptick in productivity during the pandemic, hours worked per lawyer is likely to continue decreasing as law firms continually embrace technology to shave billable hours off of tasks.”

For more insights on the law firm market and how firms are reconsidering how technology shapes productivity, download the full report.